Table Of Content

So be sure you choose an agent who has experience working with tenants with low credit scores. In the meantime, there are eleven strategies you can use to make your rental application stronger, even with a bad credit score. Depending on your income, savings, and rental history, some strategies will be easier than others.

Do you need credit to rent an apartment?

There can be more wiggle room when renting from a private landlord versus a large property management company. Even if you can’t find apartments that don't do credit checks, you might be able to make it work with the right roommates. If you're lucky enough to rent with roommates with good credit scores and meet all the other criteria of good tenancy, your prospective landlord might be more willing to rent to you. If you’re having trouble finding rentals with no credit check, consider using a cosigner or someone who voluntarily takes on the responsibility of paying rent if you can’t. From a landlord's perspective, cosigners offer a stronger guarantee that they will receive rent payments.

Offer to pay two months’ rent upfront

Whether managed by a property manager or the landlord, a quick move in will be valued. You don’t even have to actually be moved into the apartment, so long as you’re paying the rent and utility costs. In some markets, renters offer to pay a week or several weeks in advance of their actual move-in date to secure their apartment. This article will equip you with the information you need to understand whether a no-credit check apartment is a good option for you and in your market. Plus we share tips on how to build your credit score to make renting or even buying a home easier in the future. When you lack a credit history or have a lower credit score, you may find yourself wondering whether you can find an apartment rental without submitting to a credit check.

Prove income or savings balance

Lenders usually report new information to agencies every 30 days to 45 days, and sometimes quicker. You may see some improvement in your score over a month, but it depends on how much debt you have. For example, it could take as long as 18 months for your credit to recover after missed or defaulted payments or three months to improve your score if you maxed out your credit cards. Apartment List offers several tools for discovering information about rental properties and for reaching out to property owners and managers. Sign up for an account today to start searching for apartments in your area. When you use tools like Apartment List, you can find a lot of information about a prospective landlord in the description.

Q: What are the alternatives to a credit check when renting a property?

How to Buy a House With No Credit - The Motley Fool

How to Buy a House With No Credit.

Posted: Mon, 02 Oct 2023 07:00:00 GMT [source]

Restrictions and the threat of additional administrative work can make this move less appealing to some landlords. Individual investors, like those that Belong supports, are less likely to be financially impacted by the measures at this stage, with single-family homes and duplexes exempt. From 2024, Bay Area property owners with at least three units that have been vacant for more than six months will be taxed $2,500 - $5,000 per empty unit. Money collected will be invested in subsidizing affordable housing in the city, including for people over the age of 60.

First, your co-signer will need to show a good (ideally “very good”) credit score of their own. Many landlords want to see a co-signer who makes at least 80 times the monthly rent amount in yearly income. Lastly, you’re entering into a financial relationship with your co-signer. If things go wrong, such as you defaulting on rent payments, your relationship may be strained.

How to find private landlords near you

You find a good deal on an apartment while browsing rental listings online. When you call the number to inquire, the owner asks you to complete a credit check before you can see the place. If you agree, they'll send you a link to a website where you can get the credit check done. Belong homeowners earn guaranteed rent, paid to them each month even when residents are late to pay. And, in the unlikely event that residents must be evicted, Belong assists with the process so homeowners are never left stuck in the confusing legal system on their own. If you wish to reoccupy the home as an owner-occupier, you must move in within 90 days of your residents moving out.

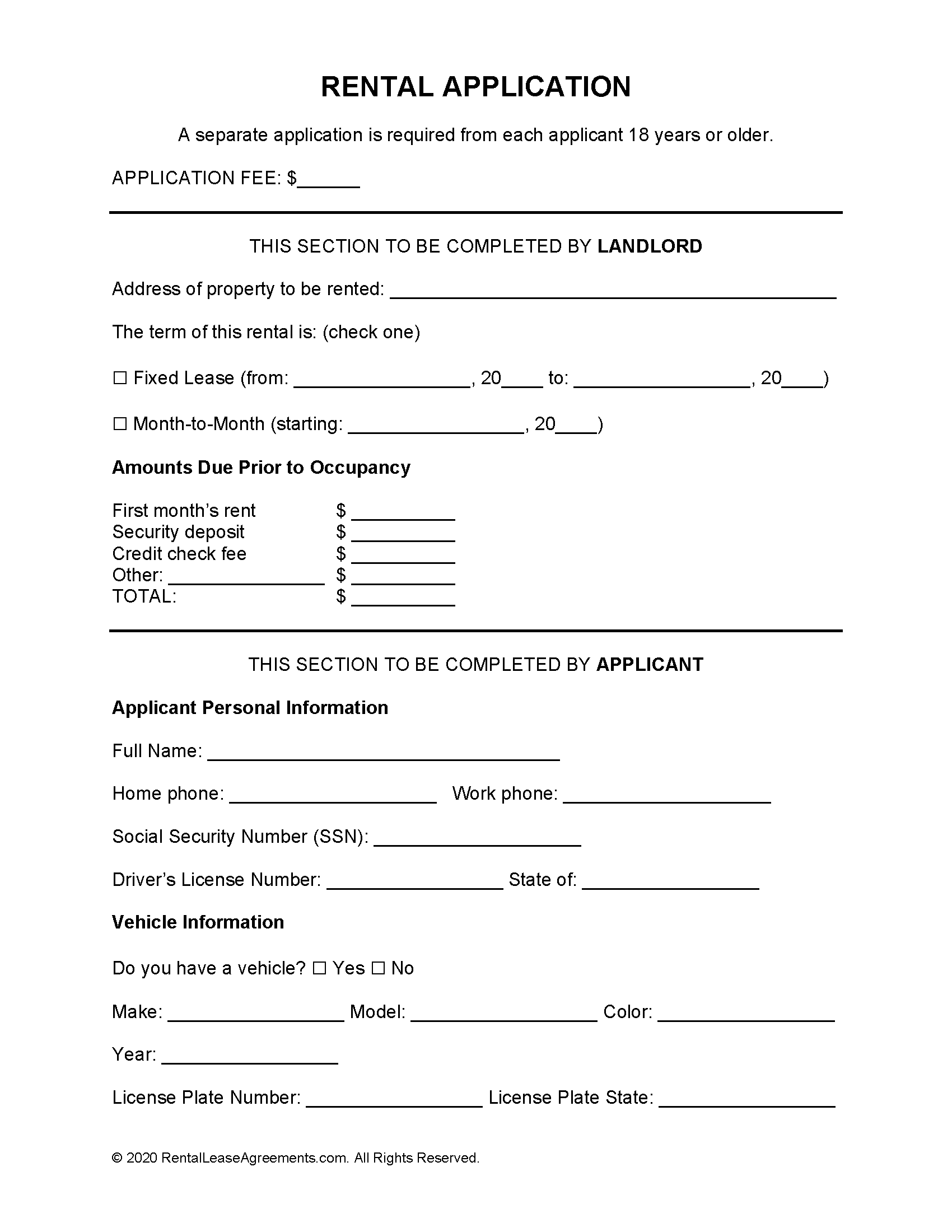

Be sure the extra money you pay is documented in the lease or other rental forms. Most apartments perform soft credit checks rather than hard credit checks. If you’re trying to avoid hard inquiries, ask about the type of credit check the leasing agent will perform, or consider apartments for rent with no credit check. According to a study by Rent Cafe from 2020, the average credit score for renters was 638. We have found that a score of 650 or higher in many places will give you the best chance of finding an apartment to rent. Luckily, many landlords won't discount a tenant solely because of their credit score.

Can a Cosigner Help Me Get an Apartment?

We’ll outline some strategies on how to rent a home even if you have bad credit so you can find your next apartment or house for rent. Trying to rent an apartment with bad credit can be difficult—and trying to do so with no credit may feel impossible since landlords typically require a credit check. But you may be able to rent an apartment without a credit score by showing steady income, getting a guarantor or cosigning with roommates. Apartment owners may consider more than your credit scores when conducting a background and credit check.

HUD works all over America so many different places offer these great benefits for renters needing extra support. The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. When you're already paying down as much as you are able, here are a few other ways to improve your credit.

You can either show a high income or high savings amount relative to the monthly rental payment. Thankfully, we’ve discovered that renting a home or apartment with no credit history isn’t just possible, but it’s a relatively straightforward process. We’ve uncovered five ways to rent with no credit check, including options that involve no credit check apartments and private landlords. While it may seem intimidating at first, you can rent a home with a bad credit report or even find a reputable apartment that offers no credit checks. There are plenty of strategies to help build your credit, make a good impression on a potential landlord, and ease the burden of the rental process. You can also see your full credit history for all three credit bureaus once per year using a free credit report service.

An alternative is providing a screenshot of your account, but the more official you can make it, the better. To help assuage the concerns of a landlord that your lack of a credit score may signal a risk, offer to pay more upfront if you are able. Consider adding to your first month, last month and security deposit with an extra month in cash. Your credit scores are calculated using information from your credit reports, so it’s important to ensure that your reports accurately represent your credit history.

If your landlord doesn’t want much information about you, you may be walking into a rental scam or an unfavorable rental situation. Always perform your due diligence when responding to a rental listing. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®.

No comments:

Post a Comment